move into the first Quarter 50% level @ 4295

Previous Weekly report

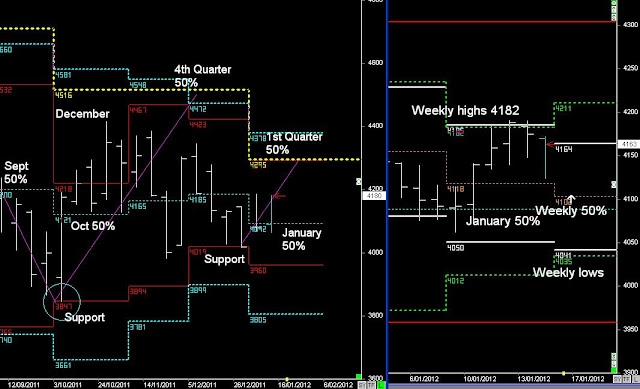

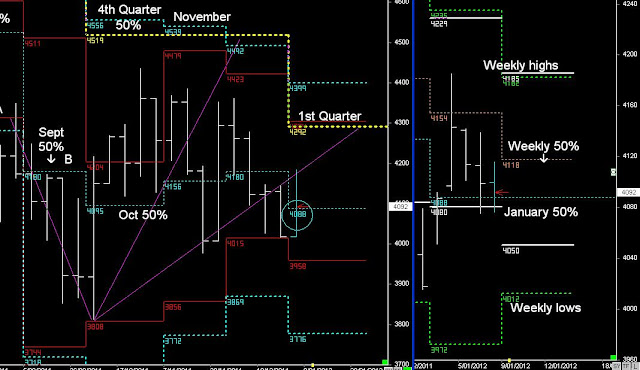

SPI Monthly and Weekly cycles

The Australian Stock market is moving up into the 1st quarterly 50% level @ 4295, which I see as resistance.

However, when we read the US index report, there is a potential 2-month wave pattern towards the February highs.

If the SPI is going to continue higher, then it's on the back of the S&P 500 moving towards 1356.

if the SPI is going to stall and reverse down...

then the S&P 500 will stall after completing of the break and extend pattern, and then begin to rotate down towards it's own February 50% level.

Either way, the Australian market counter-trend move upwards during the first Quarter is about to complete its first stage.