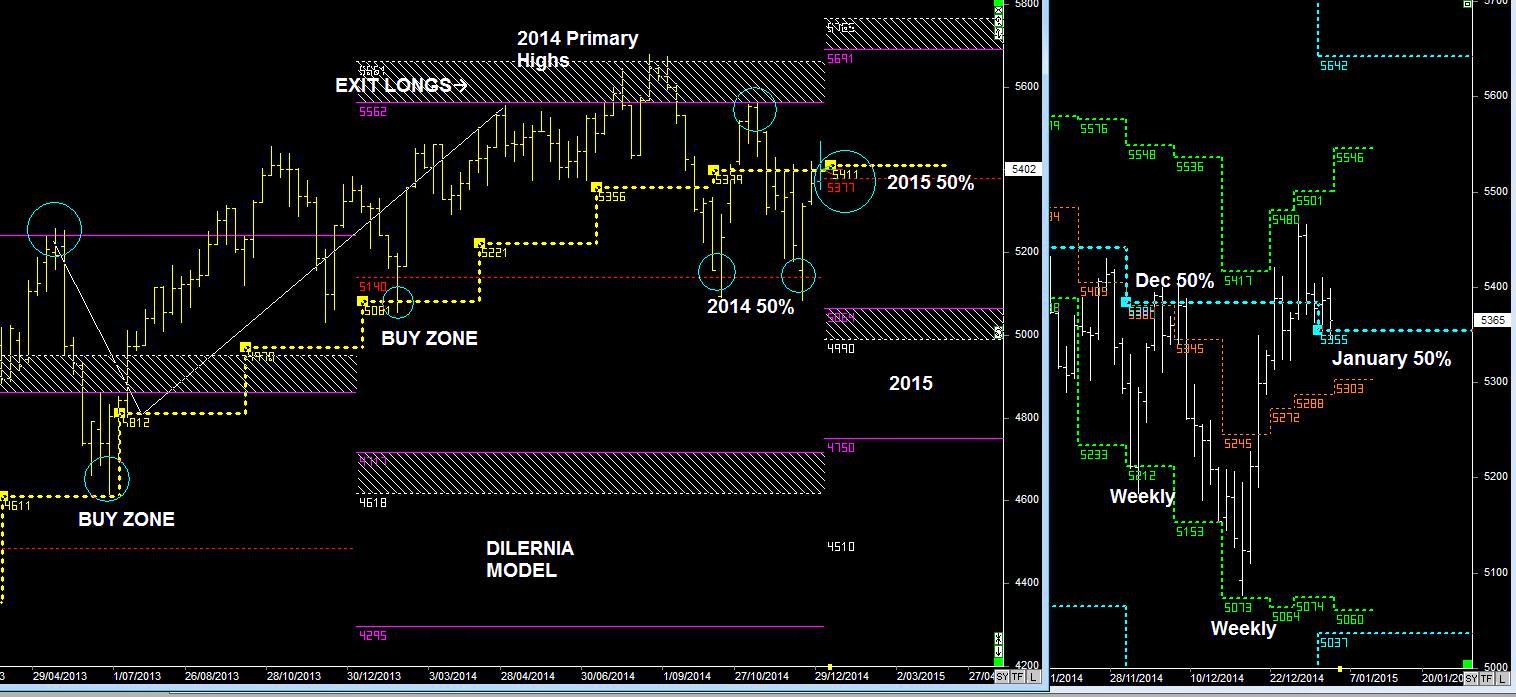

SPI Primary Cycles 2015

If you've been following my reports for a while now, you'd know that I've been bearish on the Australian Market since reaching the 2014 highs.

Normally with the alignment of the 2015 50% level, this would put pressure on the Primary cycles to move lower, as was the case with the first few weeks in January.

However, if you've read my US reports (S&P 500), you know I've been bullish, and the price action in the US has helped the Australian Market remain stable, and based on this week's price again once again move into a BULL trend. (Above 2015 50%)

However, the important pattern in the Australian market is the price action of the Precious Metals (GOLD & Silver). I was Bullish on Silver but not so much on Gold.

Both those markets now have the potential to rise upwards after being depressed for the past 2 years, which gives reason to underpin the Australian Market. (READ GOLD Report).

If GOLD & Silver is going to Rise, then keep an eye on the AUD/USD (Read Forex Report)