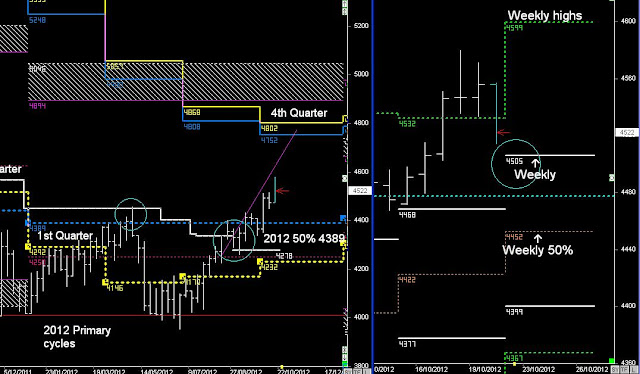

SPI Monthly & Weekly cycles

The Australian Market continues to consolidate above the October highs @ 4477, with an overall trend bias towards 4800 by year's end...

Next week is simply defined by the Weekly 50% level @ 4486...

#1) it continues higher for the next 5-days towards the November highs

or

#2) moves down into the Weekly lows, which matches the November 50% levels