SPI Primary & Monthly Cycles

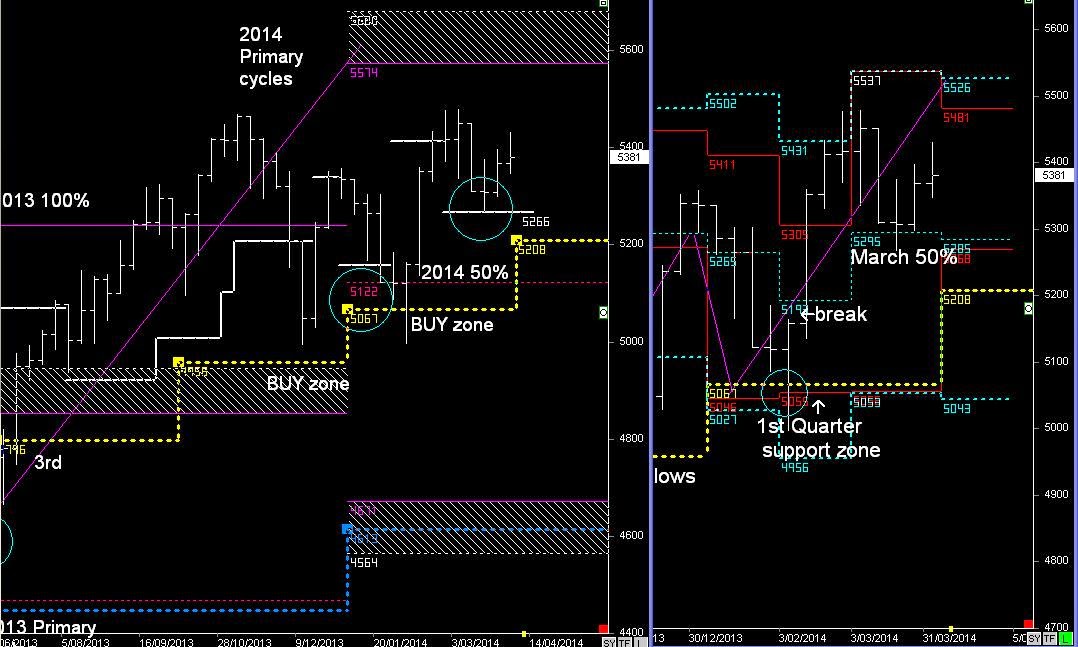

As we can see the Primary and Secondary cycles are driving the market lower.

There is current support around 2014 50% level, but the secondary Sell zone in the 4th Quarter @ 5399 has stalled the market, followed by a December break, leading to a potential move down into the January lows.

As mentioned in the previous report; below the 2015 50% level and the Primary cycles suggest further weakness in 2015, and potentially a 2-wave cycle that trends lower into 2016. (5-6 Quarters)

When we compare the Aussie Market to the S&P 500, the Primary cycles look to be moving in the opposite directions.

The S&P remains above the Primary highs in 2014, and potentially this could see a push upwards in the 1st Quarter in 2015.

If that's the case this will help the Australian market rise up into the 2015 50% level (Sell Zone).

At this stage in the Primary cycle I would be focusing on building cash reserves, whilst the market zig-zags lower of the next 5-6 Quarters. (long term investing).

Whatever happens in 2015 sets up the next long term BUY strategy in 2016 for the next 4-5years.