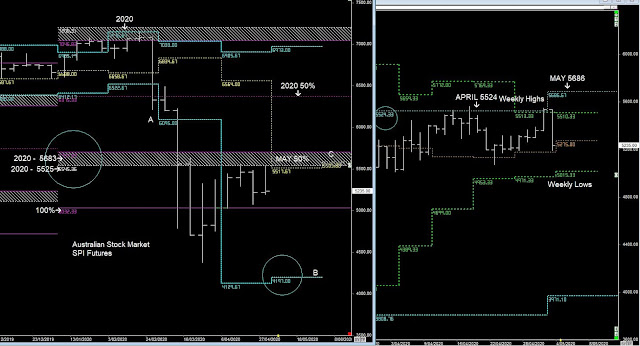

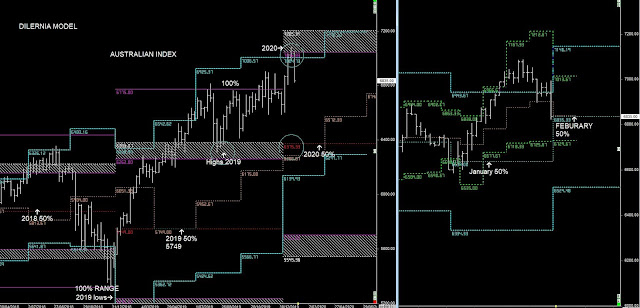

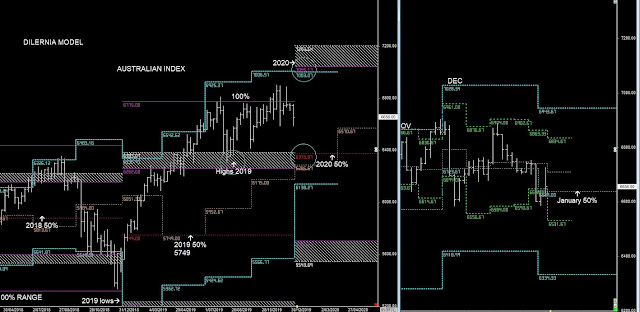

Australian Stock Market - Primary & Weekly Cycles

14th MARCH 2020

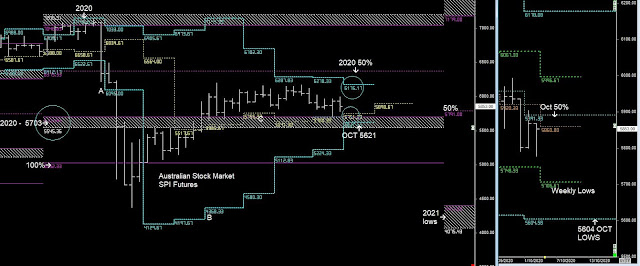

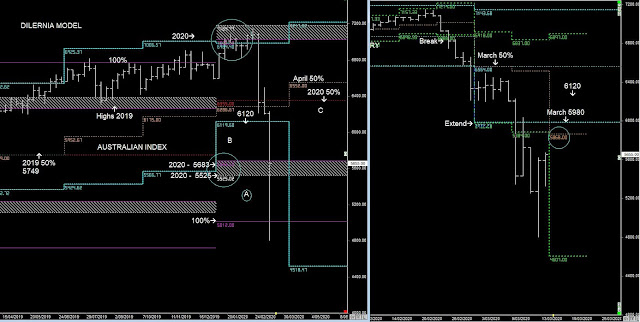

There's 3 potential price actions that may happen.

A. - remains below the 2020 lows & in between 5021

with resistance next week around these 2 levels 5868 & the March lows @ 5980

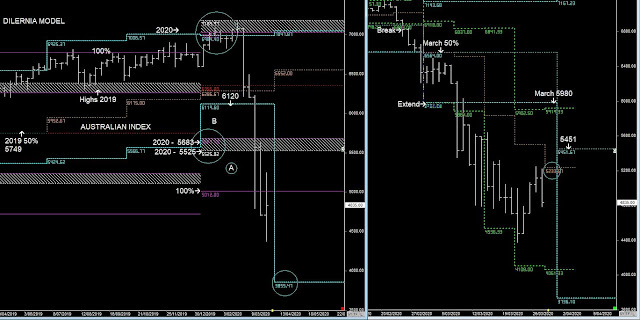

B. More short covering from 5525 up to 6120 - resistance

C: A lot of Short covering into the 2020 50% level over the next few week @ 6355 - a lot of resistance for more weakness into 2021

With a Peak around MAY June, therefore there is expected weakness into 2021 for long terms buys.

Currently we are in SET-UP A - retesting the MARCH lows at 5980

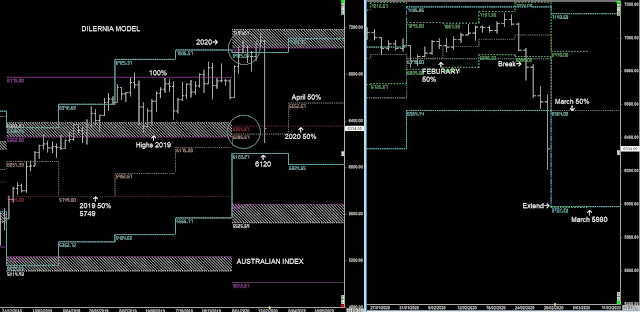

Fundamentally the economy is cactus, but the BEAR MARKET Pattern in the Australian Market has failed to materialise, and the Aussie Market has followed the S&P 500 higher (read S&P 500)

Whilst inside the 2020 lows, the trend bias is to move towards the 2020 50% level at 6375

(SET-UP C)

However, I would like to see the Weekly highs at 6017 stall the trend from going higher and retest the JUNE 50% level. (SET-UP B and into SET-UP C)

Once that happens we can validate whether the Australian Market will go higher and how high.

In conclusion -

It looks like it's going to go higher into June, but I've always have had the view that the Market is going to continue to go lower into 2021 and that it starts to unwind from the 3rd Quarter.

However, there is no SET-UP or resistance levels to validate that view at this stage.