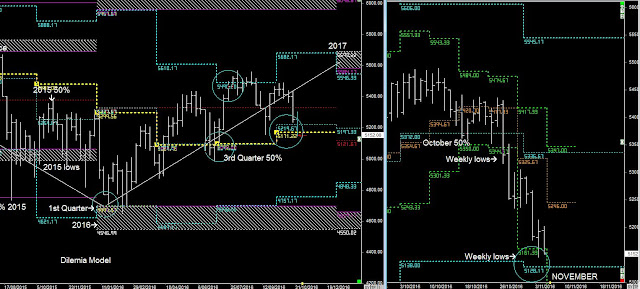

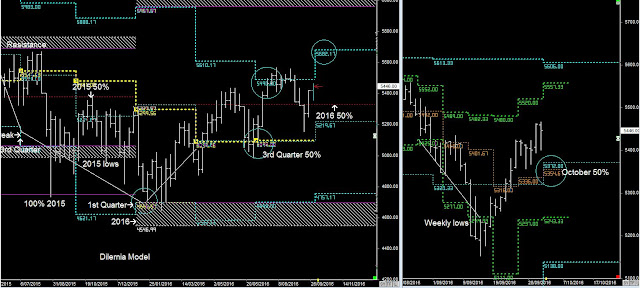

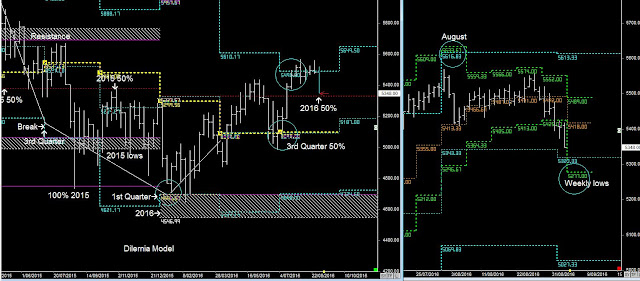

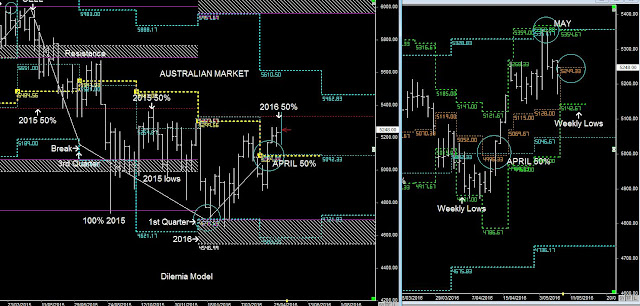

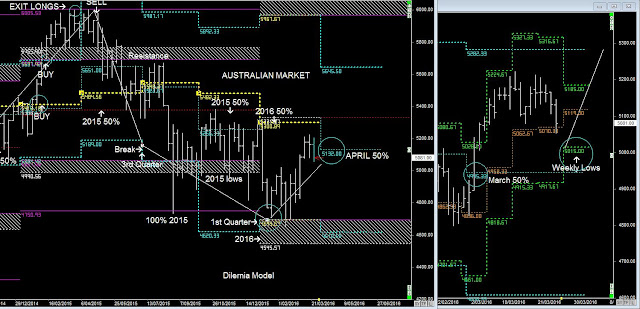

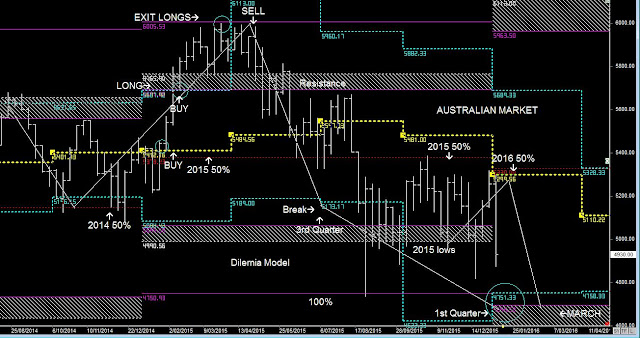

Australian Stock Market Primary Cycles 2016

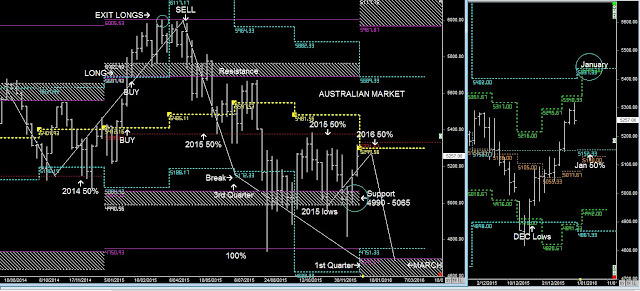

The start of the new year brings in the new Primary Cycles for 2016.

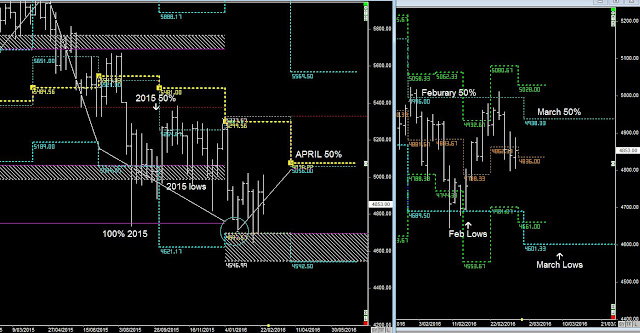

We are still in a Primary 'Bear Market' and will continue to live in a Bear Market whilst price remains below the 2016 50% level.

As you're aware I'm looking for a new wave downward into the 2016 yearly lows, as part of the 2-period timeframe wave cycle, as described in my book.

I have seen markets before kick upwards at the start of the new year, as price closes right in the middle of the NEW year 50%, but that doesn't fit in with the 'Principles' I follow.

If we look at commodities markets they are following the same bear trends and heading lower in the new year(Read Gold Report).

In conclusion:- if the bear trend follows my 'Principles' and the Australian Market is hitting 4700, especially in MARCH then it's probably time to re-enter the market.

NOTE: US Markets aren't showing the same bear pattern trends (Read US Report)