last weeks report

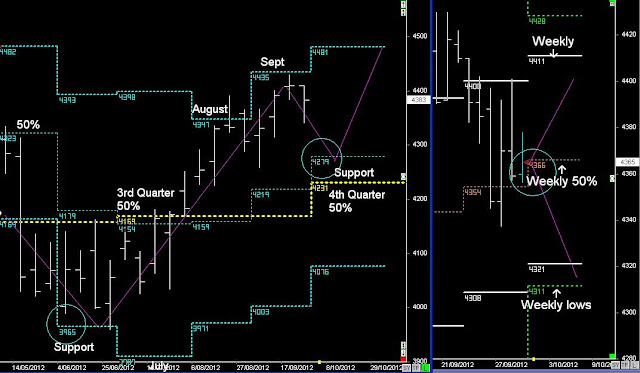

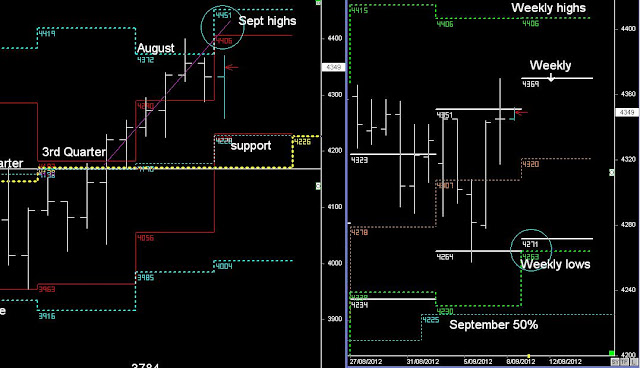

SPI Monthly and Weekly cycles

US markets did drop during the 1st two days last week, and in my opinion the trend in the Aussie is moving down into the monthly cycle Support levels @ 4279, along with the 4th Quarterly 50% level in October.

That view will be defined by the Weekly 50% level @ 4366...

and if the trend is going to continue higher in 2012, then those support levels in October are the best levels for that to happen from