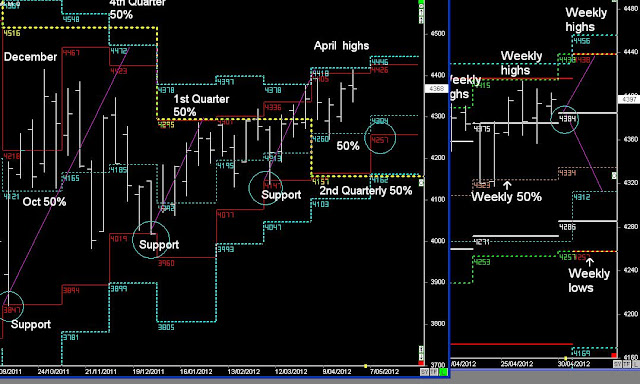

Monthly & Weekly cycles

The SPI is trading around the monthly highs, which is currently acting as resistance.... and may continue to do so until it pulls back into trailing Support levels.

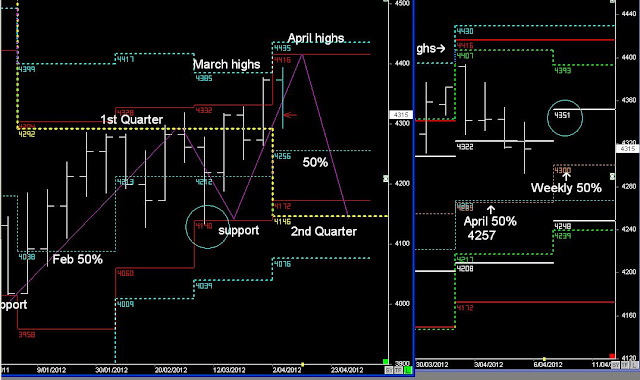

As it's been described in my latest book regarding Quarterly cycles, each UP move during the past 3 previous Quarterly cycles have aligned with the single monthly lows (RED)...

If that's going to repeat during this Quarterly cycle, then the trailing single monthly lows (RED) in the future months "a window into the Future' are levels that should be of interest for traders looking to 'TIME' longs once again.

Eventually a Robust UP trend will breakout of the monthly highs and continue to Extend up towards new highs in the following quarterly cycles, but at this stage I feel market will continue to consolidate in a large sideways band that has a slight upward bias.

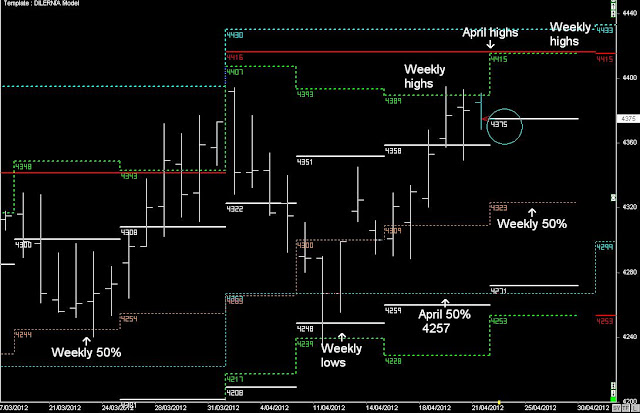

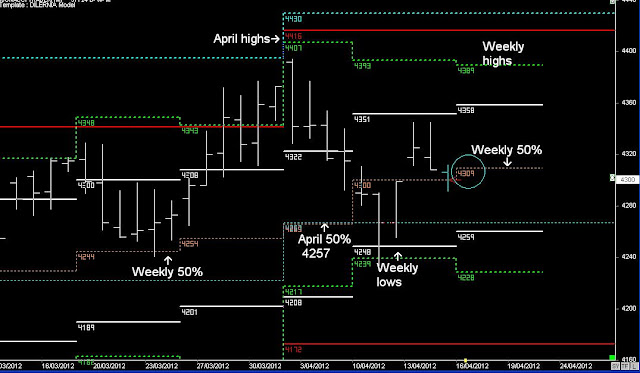

Next Week:- 4384 and the Weekly level will determine the short-term 5-day trend with in the weekly cycles

Note:- A break of monthly support will result in a minor break and extend pattern towards the Quarterly 50% level (Yellow)