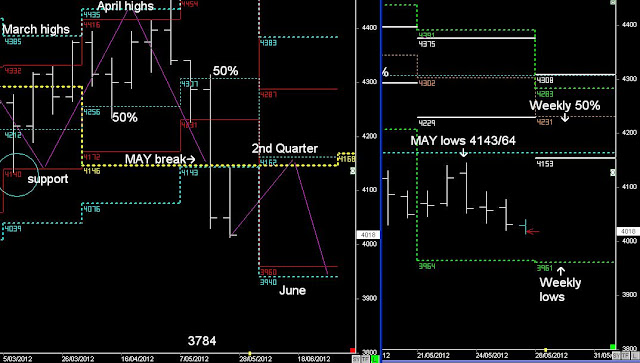

But, the Australian stock Market is going to struggle to rise higher than 4143/64 for the rest of this Quarter (Previous Weekly Report)

SPI Monthly and Weekly cycles

The Market didn't make it down into the Weekly lows, but it did test 4143, which formed resistance and pushed the stock market lower

The overall target remains around 3785 based on the Primary cycles

The Trend bias is also part of the break and extend pattern from the MAY lows into the June lows.

However, there is 1 week to go in MAY, and often price can rotate upwards into the following monthly 50% level...(June)

and then once again rejected down into the June lows, completing the break and extend pattern :- SUPPORT

Next week's lows @ 3961 will determine whether there is a counter-trend move up into the June 50% levels or not.