SPI PRIMARY & WEEKLY CYCLES

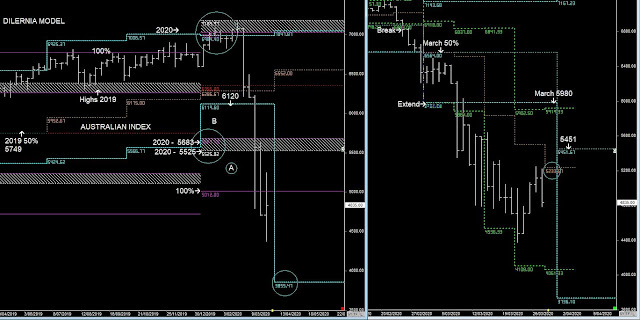

Resistance below the 2020 lows and now breaking the 100% range at 5021.

I would read the US REPORT (S&P 500), to get a better idea, that even though it's below 5021, I'm expecting a counter-trend rally in April of 50% of the range from the Highs in January Highs and the new lows that will be set soon.

However, LONG TERMS BUYS REMAIN IN 1st QUARTER LOWS in 2021, as I'm expecting more weakness from JUNE.

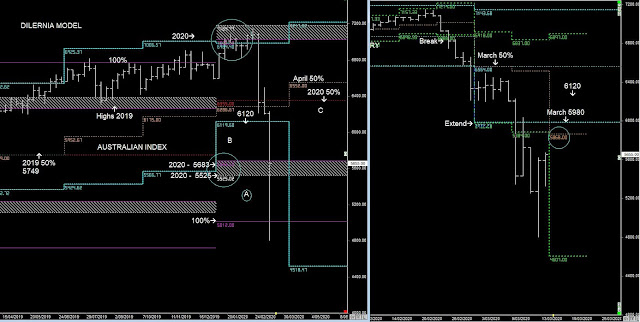

THERE WAS A LARGE COUNTER-TREND RALLY IN THE S&P 500, AND THE AUSTRALIAN MARKET TRIED ITS BEST TO FOLLOW BUT DIDN'T HAVE THE SAME LEGS.

APRIL BEGINS NEXT WEEK, BUT I'M STRUGGLING TO SEE A 50% RETRACEMENT AFTER LAST WEEK'S PRICE ACTION

WE CAN SEE THE BREAK AND EXTEND PATTERNS DOWN TOWARDS 4061 & 3855.

THERE'S STILL NO REASON TO BE BUYING INTO THE MARKET UNTIL 2021.