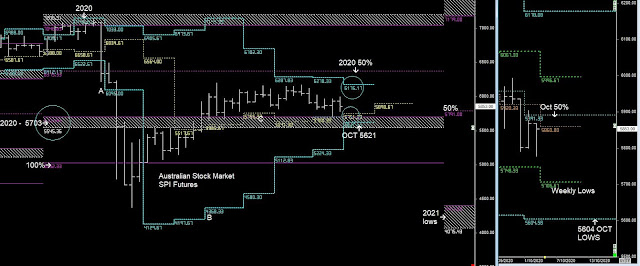

SPI PRIMARY & WEEKLY CYCLES

AUSSIE MARKET REMAINS IN A BEAR TREND, AND IT DOESN'T TAKE TOO MUCH FOR THE NOVEMBER LOWS TO BREAK AND SEE THE MARKET DROP MUCH LOWER INTO 2021

THE US ELECTION WILL HAVE A MASSIVE BEARING ON THE STOCK MARKET TRENDS.

A TRUMP WIN WILL BE POSITIVE, A BIDEN WIN I'M SURE WILL BE NEGATIVE, - RAISING TAXES AND SHUTTING THE ECONOMY.

SURE THE MARKET CAN RISE, BUT I WOULD RATHER VERIFY THAT USING THE 2021 50% LEVEL AS THE TREND GUIDE IN JANUARY