SPI Primary & Weekly Cycles

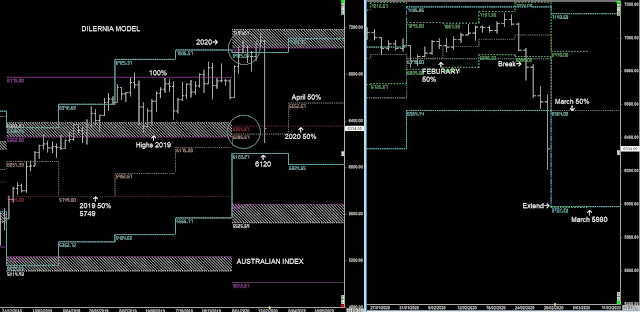

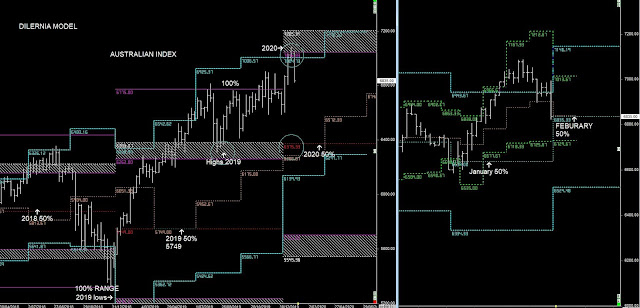

The Australian Stock Market completes its 4 year cycle highs in 2020.

I personally wouldn't be looking to BUY long term unless there's a decent downtrend to at least the Yearly lows ( 2 year lows)

However, the Yearly 50% level @ 6375 - 6320 could & should provide some Support in the first 2 quarters of 2020. Previous Report

READ S&P 500 Report

Selling hit Global Markets once the US markets completed their 2020 highs and we can now see a retrace into the 2020 50% level, which is now supporting price.

There is a break and extend pattern in the Weekly cycles, that could see price push down into 6120 and as far as 5980, however I think there should be support and short-covering this week.

It will be hard to see it going higher than the MARCH 50% level and February lows @ 6564 - Retest of the Break down - RESISTANCE.

At this stage there is no reason to be buying into the Market for BUY & HOLDS, otherthan short-term volatility on the upside into Resistance levels

Next Long Term buy is the 2021 Lows