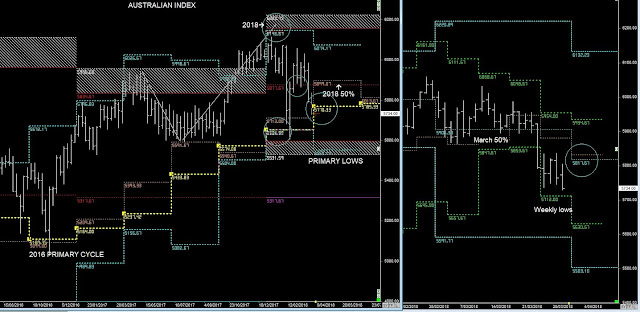

SPI Primary & Weekly Cycles

I'm still in the bullish camp, and these retracements in February are just part of the Primary Cycle patterns that are expected once. I still favour a rise up into 2020/21, so bullish for another 2 years.

Currently the Australian Market is trading above the Yearly 50% level, but it might take a number of weeks for the volatility to subside, as the Weekly lows creep upwards and is used for support for the next move upwards in Late March, Early April (previous Report)

It had everything going for it, consolidation above the Yearly & Monthly March 50% level for 3 weeks, but then weakness on the back of China's response to Trump's tariffs over the last 5-days.

Therefore the Late March & Early April continuation of the BULL Trend doesn't look like it's going to happen.

There's a pattern in the S&P 500 (emini) playing out, which will define whether the Market will rise or whether the start of the 'trade wars' is putting a major pressure on Primary Stock Market Trends.