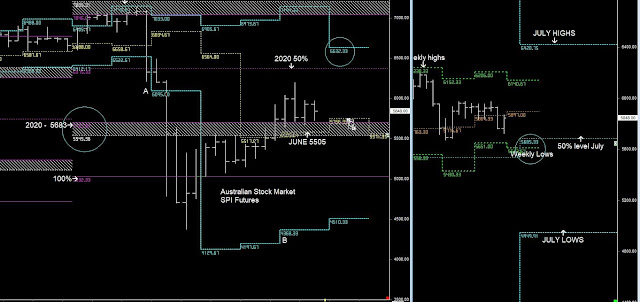

Australian Stock Market - Primary & Weekly Cycles

Whilst above the Yearly lows at 5683 the bias is to continue higher towards the 2020 50% level at 6375

Weekly cycles continue to be bullish, but I still would like to see the June 50% level tested to validate whether it will continue towards the 2020 50% level

Still trading above the 2020 lows, but I'm surprised it hasn't move as high as the 2020 50% level @ 6375

Around the July 50% level, it will also match the monthly lows, providing a robust support zone for that move upwards 6375 to 6420

However, read the S&P 500 report, because what looks like a good set-up for a move higher can lead to a break of support and down into the July lows and then the August lows.

Therefore below the Weekly lows at 5613 is open to Risk in July.