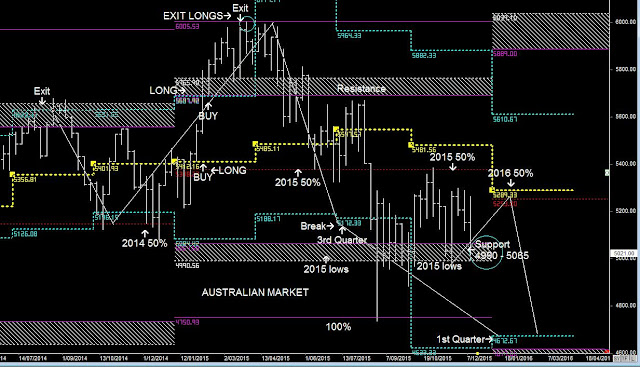

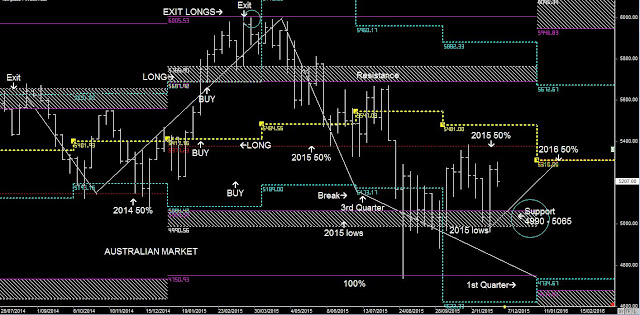

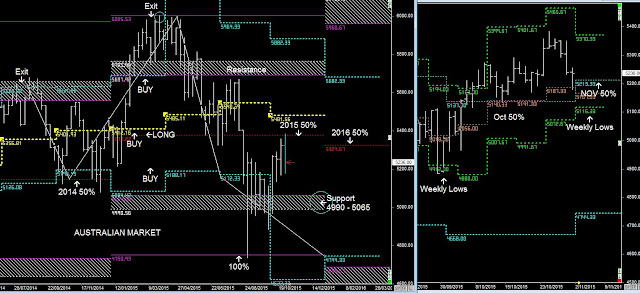

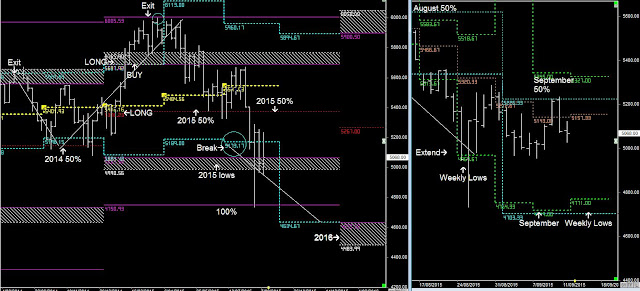

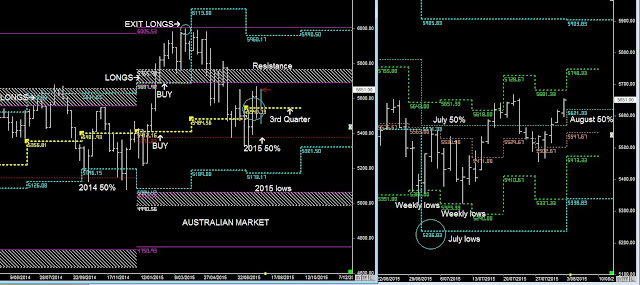

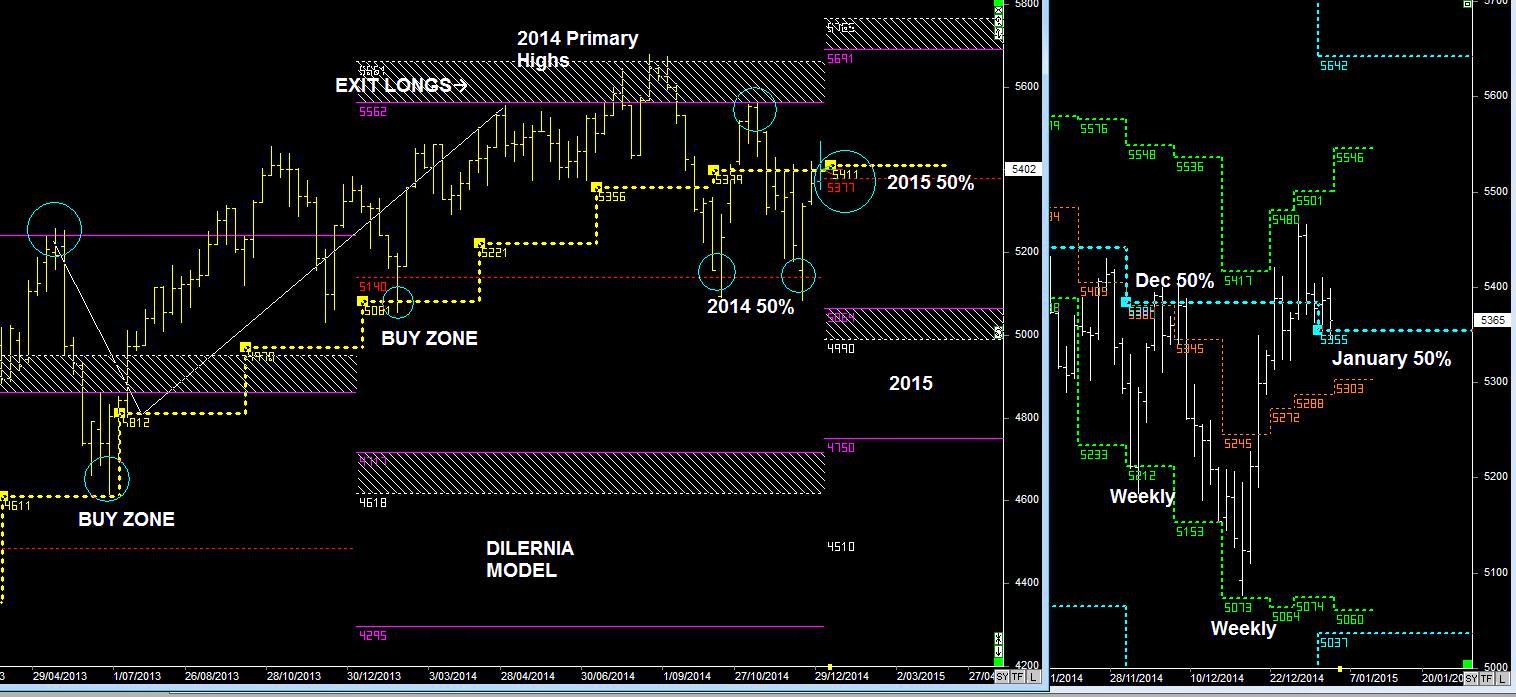

"As noted in the previous report, the BEAR-Market pattern often extends towards the 2016 lows, If we use historical patterns clearly described in my book :-Market Trading Market Timing, then we should see some consolidation around the current 2015 lows, but then further weakness from the 4th Quarter down into the 1st Quarter lows some time in March 2016

If that plays out, then I'd look to move back into Long positions in the Aussie Market 6 months from now, using the 2016 lows as support & entry" (September Report)

SPI Primary Cycles

As you probably aware I'm bearish on the Aussie Market, and so far the market is consolidating around the 2015 lows.

If we follow the pattern as previously described, the Market should be heading down towards 4600. and if it's reaching those lows around March, then it's a good time to rock & roll.

Note:- Market Trading Market Timing is probably the best T.A book on the market.

Merry Christmas.