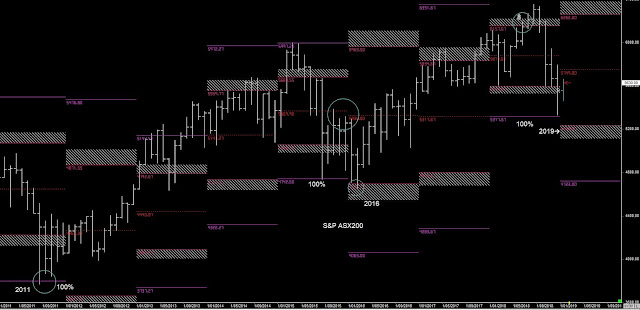

SPI PRIMARY & WEEKLY CYCLES

The Australian Stock market has moved down 100% of the Range in 2018. We see these patterns often at the start of BEAR CYCLES.

Expectation that price will continue lower from the 2019 50% level, move down into the 2019 lows and then make higher highs going into 2020.

Even though there's bearish patterns in all INDEX MARKETS, there's too much good economic news coming out of the US for the BEAR trends not to go lower than the 2019 lows.

NOTE:- Instead of going down into the 2019 lows, Price could go up towards the Quarterly/Secondary cycles (YELLOW) by the 2nd Quarter. IF that happens then there's less likely the market will complete the move down into the 2019 lows, but kick higher in the 3rd Quarter.

PRIMARY CYCLES

We can see the 100% LOWS in 2011, 2015 and 2018.

The Question now is....

Will 2019 play out the same as 2016 (double Yearly low) or will it follow a similar pattern as 2012 and continue higher in the 3rd Quarter?

Note:- the only failure of the 100% low that didn't support the market was in 2008 during the GFC, but it completed the Bottom at the 2009 lows (double Yearly low)

Overall - BULLISH Long Term

Bearish Short-term