SPI Primary & Weekly Cycles

As noted in the Previous Report, I still wanted to see some downside in the Australian market, as it hadn't followed the 'TEXT-BOOK' support patterns.

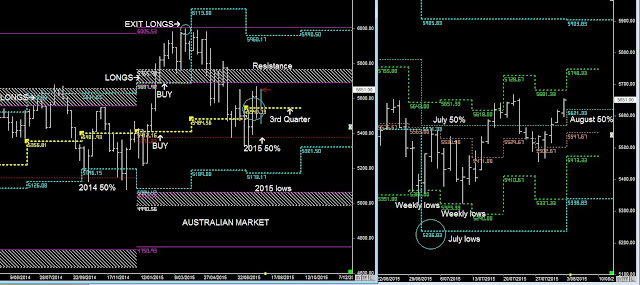

We can now see the Market sell-off began with the breakout of the Weekly lows @ 5474, and likely to move down into this week's lows @4969, and ideal zone to be looking for a short-term swing pattern.

We are also testing the 3rd Quarter lows.

We also have to acknowledge the SPI is now officially in a bear trend, and bear markets often follow trends lower into 2016. (2-pattern extension into the following yearly lows)

Therefore any short-term support (READ S&P 500 report) must treat the 2015 50% as resistance for the rest of the year